- contact@verticalserve.com

At Insurance POD, we specialize in transforming insurance companies through cutting-edge AI, Data, and Automation solutions. With expertise spanning Underwriting, Claims, and Reinsurance across Personal and Commercial Property/Casualty lines, our services are designed to elevate your operations and drive strategic growth.

Automate risk assessment, pricing, and policy issuance. Leverage data-driven insights. Implement AI-powered underwriting workstations for efficiency.

Optimize claims triage and automate low-value processes. Use AI to detect fraud and streamline claim settlement. Provide predictive insights to enhance claims reserving and processing.

Automate treaty management and ceded reinsurance processes. Use data analytics for better risk transfer strategies. Enhance reporting and compliance through automated solutions.

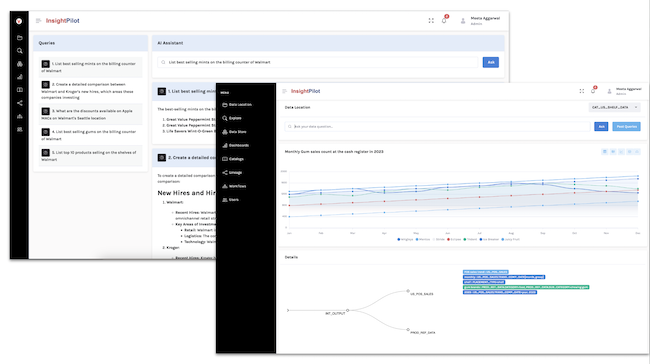

Enterprise Copilot is a state-of-the-art GenAI solution designed to transform how organizations retrieve and manage data. It leverages advanced natural language processing to extract intelligence from a wide array of sources, making data retrieval intuitive and efficient.

InsightUW is an all-in-one underwriting platform that leverages AI and automation to revolutionize how underwriters handle submissions, manage documents, and make risk-based decisions. From automatically extracting data to managing endorsements and renewals, InsightUW provides a seamless and intelligent underwriting experience tailored to specific lines of business (LOBs).

InsightTrends delivers a 360° view of industries and companies by combining market intelligence with granular company data. From industry classification and emerging trends to detailed company profiles and financials, InsightTrends is your go-to platform for reliable and current information on your insureds and brokers.

VerticalServe collaborates with leading cloud, big data, and ML/AI platforms, including GCP, AWS, Cloudera, Confluent, Matillion, and Automation Anywhere. We operate as an extension of their professional services or consulting teams, working in close coordination with product teams. By representing our partner companies, we assist their clients with Architecture, Deployment, and Development.

Over the past decade, we've successfully catered to more than 60+ clients spanning leading organizations in Retail, Healthcare, Utilities, Technology, Manufacturing, and AdTech sectors.

Our consulting firm offers fixed cost pricing, providing businesses with a transparent, predictable, and risk-free pricing model. This approach allows for simplified decision-making, enhanced accountability, and more effective budget management, enabling organizations to focus on achieving their project goals with confidence and peace of mind.

Our consulting firm embraces the Time and Material pricing model, offering businesses a flexible and adaptable approach to project pricing. This model ensures that clients pay only for the actual time and resources utilized, fostering a collaborative environment that accommodates evolving project requirements and encourages innovation, while maintaining a strong focus on delivering high-quality results.

Our consulting firm offers a flexible pay-as-you-go or credit-based pricing model, allowing businesses to effectively manage costs while accessing our expert services on-demand. This adaptable approach ensures that clients pay only for the services they need, when they need them, fostering a cost-efficient and agile partnership that supports evolving business requirements and maximizes return on investment.